Earn A Rate Of Return & Build The Kingdom

Invest with Purpose

OUR RATES

Current rates as of March 1, 2024.

All rates variable.

The purchase of MBLF’s securities is subject to risks, which are described in our Offering Circular. This is not an offer to sell you our securities and we are not soliciting you to buy our securities. We will offer and sell our securities only in states where authorized. The offering is made solely by the Offering Circular. Not FDIC or SIPC Insured. Not a Bank Deposit. No U.S. Conference Guarantee.

- Available to Individuals and Organizations

- $100 minimum investment

- On demand* maturity

- Available to MB Organizations and certain employees of MB Organizations

- $100 minimum investment

- On demand* maturity

- Available to Individuals and Organizations

- $1,000 minimum investment

- Available to Individuals and Organizations

- $1,000 minimum investment

- Available to Individuals and Organizations

- $1,000 minimum investment

- Available to Individuals and Organizations

- $1,000 minimum investment

- Available to Individuals and Organizations

- $1,000 minimum investment

IRAs (Individual Retirement Account)

An IRA is a personal savings plan that provides income tax advantages to individuals saving for retirement. IRAs can be invested at our standard rates. Traditional, Roth or Simple IRAs are available. We recommend you consult your tax advisor as to the impact an IRA can have for you.

- Earnings grow tax-deferred.

- Contributions may be tax deductible.

- Maximum contribution of $6,500/year.

- Catch-up contribution of an additional $1,000/year for persons age 50 and up.

- Required Minimum Distributions (RMD) after age 70 1/2.

- Distributions before age 59 1/2 are subject to penalty tax, unless you have an early distribution exception.

- Can transfer any qualified retirement plan directly into a Traditional IRA without owing taxes or penalties.

- Earnings grow tax-free.

- Contributions are not tax deductible.

- Maximum contribution of $6,500/year.

- Catch-up contribution of an additional $1,000/year for persons age 50 and up.

- Generally, contributions can be withdrawn at any time tax-free.

- Distributions not required during the lifetime of the Roth IRA original owner.

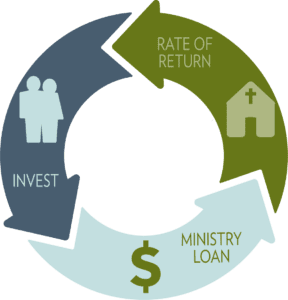

HOW IT WORKS

Earn a rate of return and build the Kingdom. When you invest with MB Foundation you are investing in ministry. Your investment provides capital for our loan program. While you earn a rate of return, we help churches reach their full ministry potential. We call that an investment with purpose. We call that Giving Meaning to Money®!